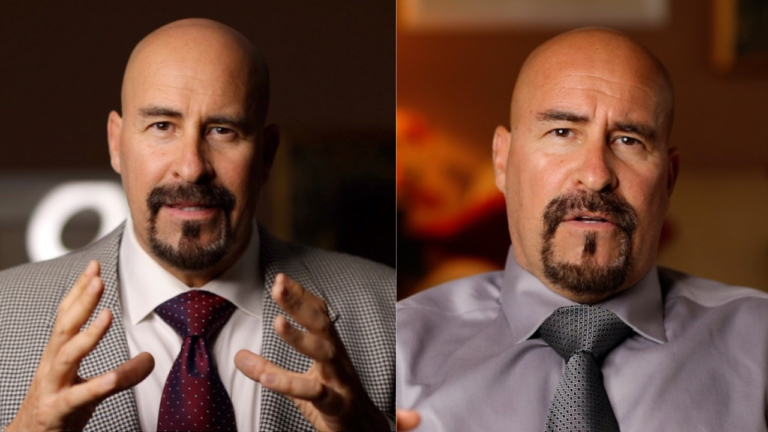

The importance of financial resilience and preparedness cannot be overstated in an era marked by economic volatility and unforeseen global events. Jeremiah Babe, a prominent figure in economic commentary, offers valuable insights into navigating these uncertain times. His perspectives on financial resilience and economic preparedness provide practical guidance for individuals seeking stability in an unpredictable world.

Understanding Financial Resilience

Financial resilience refers to an individual’s ability to withstand and recover from financial shocks, such as sudden income loss, unexpected expenses, or economic downturns. It encompasses having adequate savings, manageable debt levels, and the capacity to adapt to changing financial circumstances. Jeremiah Babe emphasizes that building financial resilience is not merely about accumulating wealth but about cultivating habits and strategies that enable individuals to maintain economic stability amid adversity.

Strategies for Economic Preparedness

Jeremiah Babe advocates for proactive measures to prepare for economic challenges. He underscores the importance of creating a comprehensive financial plan that includes budgeting, saving, and investing. A well-structured budget helps individuals track income and expenses, identify areas for cost reduction, and allocate funds toward savings and investments. Establishing an emergency fund is crucial, as it provides a financial cushion during unexpected events, reducing the need to rely on credit or loans.

Another critical strategy is investing in diverse assets. Jeremiah Babe suggests that diversification can mitigate risks associated with market volatility. By spreading investments across various asset classes, individuals can protect their portfolios from significant losses in any market segment. Additionally, he advises staying informed about economic trends and adjusting investment strategies accordingly to align with changing market conditions.

Focus on Self-Sufficiency and Minimalism

Beyond financial strategies, Jeremiah Babe emphasizes the value of self-sufficiency and minimalism. He advocates for reducing dependence on external systems by developing skills such as gardening, basic repairs, and other self-reliant practices. This approach decreases living expenses and enhances one’s ability to cope during economic disruptions.

Adopting a minimalist lifestyle involves prioritizing needs over wants, leading to more mindful spending and reduced financial stress. By focusing on essential possessions and experiences, individuals can allocate more resources toward savings and investments, thereby strengthening their economic resilience.

Addressing Economic Uncertainty: Preparing for Future Risks

Jeremiah Babe acknowledges that economic uncertainty is an inherent aspect of modern life. He advises individuals to anticipate potential risks and prepare accordingly. This includes staying informed about global economic indicators, understanding how geopolitical events may impact personal finances, and being ready to adapt financial plans as circumstances evolve.

Regularly reviewing and updating financial plans ensures they remain relevant and practical. Jeremiah Babe recommends periodic assessments of one’s financial situation, including evaluating debt levels, investment performance, and savings goals. This proactive approach enables individuals to make informed decisions and maintain economic stability even during turbulent times.

Jeremiah Babe’s Approach to Investments and Wealth Preservation

In his discussions of investments, Jeremiah Babe emphasizes the importance of wealth preservation over aggressive growth. He advocates for conservative investment strategies that prioritize capital protection, especially during economic instability. This includes investing in tangible assets such as precious metals, which have historically retained value during market downturns.

Additionally, he highlights the significance of understanding one’s risk tolerance and aligning investment choices accordingly. Individuals can develop investment portfolios that offer stability and meet long-term objectives by assessing personal financial goals and risk appetite.

Lifestyle Adjustments for Financial Health

Jeremiah Babe underscores that financial health is closely linked to lifestyle choices. He encourages individuals to adopt habits that promote economic well-being, such as living within one’s means, avoiding unnecessary debt, and prioritizing spending on essential items. Practicing frugality and mindful consumption can lead to significant savings over time, contributing to greater financial resilience.

Moreover, he advises against lifestyle inflation—the tendency to increase spending as income rises. By maintaining a consistent standard of living despite income growth, individuals can allocate additional funds toward savings and investments, enhancing their financial security.

Conclusion: Building a Secure Financial Future with Jeremiah Babe’s Principles

Jeremiah Babe’s insights into economic preparedness and financial resilience offer practical guidance for individuals seeking stability in an unpredictable economic landscape. Individuals can build a robust financial foundation by implementing strategies such as comprehensive financial planning, embracing self-sufficiency, preparing for economic uncertainties, adopting conservative investment approaches, and making mindful lifestyle choices. These principles safeguard against financial shocks and empower individuals to navigate economic challenges with confidence and resilience.

Read More: Unsellable Houses Twins.